Melexis Q2 2020 resultaten – Omzet van 100.4 miljoen EUR in het tweede kwartaal

Tussentijdse verklaring, opgesteld door de Raad van Bestuur

Ieper, België – 29 juli 2020, 07.00 uur CET

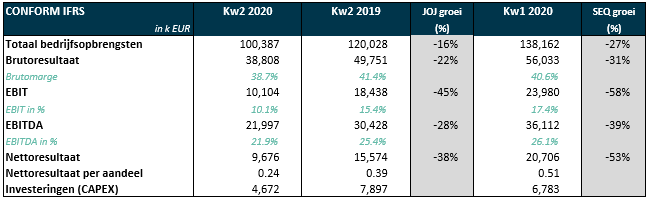

De omzet voor het tweede kwartaal van 2020 bedroeg 100.4 miljoen EUR, een daling van 16% in vergelijking met hetzelfde kwartaal van het vorige jaar en een daling van 27% in vergelijking met het vorige kwartaal.

De evolutie van de EUR/USD wisselkoers had een positieve impact van 1% op de omzet in vergelijking met hetzelfde kwartaal van het vorige jaar en geen impact in vergelijking met het vorige kwartaal.

Het brutoresultaat bedroeg 38.8 miljoen EUR of 38.7% van de omzet, een daling van 22% in vergelijking met hetzelfde kwartaal van het vorige jaar en een daling van 31% in vergelijking met het vorige kwartaal.

De onderzoeks- en ontwikkelingskosten beliepen 18.1% van de omzet. De algemene en administratiekosten stonden in voor 7.1% van de omzet en de verkoopskosten bedroegen 3.3% van de omzet.

Het bedrijfsresultaat bedroeg 10.1 miljoen EUR of 10.1% van de omzet, een daling van 45% in vergelijking met hetzelfde kwartaal van het vorige jaar en een daling van 58% in vergelijking met het vorige kwartaal.

De nettowinst bedroeg 9.7 miljoen EUR of 0.24 EUR per aandeel, een daling van 38% in vergelijking met 15.6 miljoen EUR of 0.39 EUR per aandeel in het tweede kwartaal van 2019 en een daling van 53% in vergelijking met het vorige kwartaal.

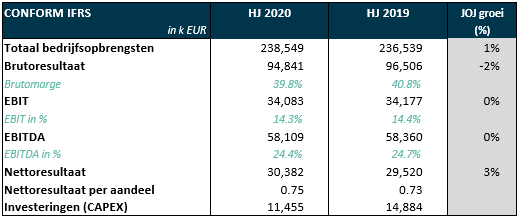

De omzet voor het eerste halfjaar van 2020 bedroeg 238.5 miljoen EUR, een stijging van 1% in vergelijking met het eerste halfjaar van 2019.

De evolutie van de EUR/USD wisselkoers had een positieve impact van 1% op de omzet in vergelijking met het eerste halfjaar van 2019.

Het brutoresultaat bedroeg 94.8 miljoen EUR of 39.8% van de omzet, een daling van 2% in vergelijking met dezelfde periode vorig jaar. De onderzoeks- en ontwikkelingskosten beliepen 16.2% van de omzet. De algemene en administratiekosten stonden in voor 6.3% van de omzet en de verkoopskosten bedroegen 3.0% van de omzet.

Het bedrijfsresultaat bedroeg 34.1 miljoen EUR of 14.3% van de omzet, bijna stabiel in vergelijking met 34.2 miljoen EUR in hetzelfde halfjaar van 2019.

De nettowinst bedroeg 30.4 miljoen EUR of 0.75 EUR per aandeel, een stijging van 3% in vergelijking met 29.5 miljoen EUR of 0.73 EUR per aandeel in het eerste halfjaar van 2019.

Dividend

De Raad van Bestuur heeft beslist een tussentijds dividend uit te keren van 1.30 EUR bruto per aandeel. Het Melexis-aandeel zal vanaf 20 oktober 2020 ex-coupon worden verhandeld (beursopening). De registratiedatum is 21 oktober 2020 (beurssluiting) en het dividend is betaalbaar vanaf 22 oktober 2020.

Vooruitblik

Melexis verwacht dat de omzet van het derde kwartaal van 2020 ongeveer 10% boven het niveau van het tweede kwartaal zal uitkomen.

Business commentaar – Françoise Chombar, CEO:

“Ondanks de COVID-19-pandemie is Melexis erin geslaagd in het eerste halfjaar van 2020 een omzetgroei van 1% te realiseren in vergelijking met het eerste halfjaar van 2019. Ik ben dankbaar voor en trots op de manier waarop het Melexis-team met deze uitdagende tijden is omgegaan. Verstoringen aan vraag- en aanbodzijde werden op een efficiënte manier aangepakt, kostenbesparingen werden – waar mogelijk – op doeltreffende wijze geïmplementeerd.

Hoewel het klantensentiment en het bestelgedrag fragiel blijven en de visibiliteit nog steeds zwak is, bevestigen wij dat het tweede kwartaal het dieptepunt betekende en dat we nu kunnen uitkijken naar een pad van herstel. In het derde kwartaal verwachten we een omzetgroei van ongeveer 10% in vergelijking met het vorige kwartaal, voorzover de tweede golf van COVID-19 niet dezelfde financiële impact zal teweegbrengen als ervaren in het tweede kwartaal.

De verkoop aan klanten in de automobielsector bedroeg 86% van de totale omzet in het tweede kwartaal van 2020 en 89% van de totale omzet in de eerste helft van 2020. Het gedeelte van standaard producten (ASSPs) vertegenwoordigde 69% van de totale omzet in het tweede kwartaal van 2020 en 67% van de totale omzet in de eerste helft van 2020.

De groei in aangrenzende markten, zowel absoluut als relatief, werd gerealiseerd door meerdere productlijnen. Zo zagen we groei in smart drivers, druksensoren en magnetische sensoren voor motorfietsen, scooters en driewielers. Een toegenomen tractie in gaming-applicaties als gevolg van de wereldwijd verhoogde consumentenbelangstelling tijdens de lockdown, en gestimuleerd door de lancering van de volgende generatie gaming-GPU’s, bevorderde de vraag naar onze single-coil ventilatordrivers. De sterkere vraag vanuit de zonne-energiesector verhoogde onze omzet in stroomsensoren. Ten laatste, maar niet minder belangrijk, bleven onze temperatuursensoren, die kritische componenten zijn voor veel van de hulpmiddelen die dienen voor het overwinnen van de COVID-19-pandemie, erg in trek. De applicaties gaan van diagnostiek over systemen voor het monitoren van patiënten tot een waaier aan lichaamsthermometers. Hoewel al deze markten de neiging hebben om veranderlijk te zijn van kwartaal tot kwartaal, dragen zij bij tot duurzame bedrijfsvoering op lange termijn.”

De commissaris PwC Bedrijfsrevisoren bv, heeft bevestigd dat de review van het ontwerp van de tussentijdse geconsolideerde jaarrekening nagenoeg beëindigd is en dat tot op heden geen materiële afwijkingen werden vastgesteld. De commissaris heeft tevens bevestigd dat de boekhoudkundige informatie opgenomen in het bijgevoegd ontwerp van perscommuniqué, zonder materiële afwijkingen overstemt met het ontwerp van de tussentijdse geconsolideerde jaarrekening op basis waarvan het is opgemaakt.

Financiële kalender- Betaaldatum dividend: 22 oktober 2020 (ex-coupon op 20 oktober 2020)

- Publicatie resultaten Q3 2020: 28 oktober 2020 (om 7 uur CET)

- Publicatie resultaten FY 2020: 3 februari 2021 (om 7 uur CET)

Download persbericht (PDF - 747 kB)